401(k) and IRA Limits Are Rising: Hey folks—good news and a reality check for anyone thinking about retirement savings in 2026. The IRS just dropped the new limits for 401(k) and IRA contributions, and they’re higher than ever before. That means you can stash away more dough for your golden years, which is awesome, right? But let’s be real: saving more isn’t as easy as just hitting a new number. With inflation, rising living costs, and other financial pressures, many Americans wonder—is it actually possible to keep pace with these changes? This article cuts through the jargon and breaks down what the new 2026 contribution limits mean, how you can take advantage, and some candid tips to help you actually build your retirement pot. Whether you’re fresh out of college, juggling family expenses, or nearing retirement, this guide is for you. Let’s dive in.

Table of Contents

401(k) and IRA Limits Are Rising

The 2026 increase in 401(k) and IRA contribution limits is a golden opportunity to save more—if you can make it work in your budget. Yes, the cost of living and financial challenges can make maxing out tough. But consistent, smart saving—starting now and adjusting as you go—sets up a much stronger retirement. Grab your employer match, automate your savings, and remember that even small steps move you closer to a secure retirement. Your future self will thank you for getting started today.

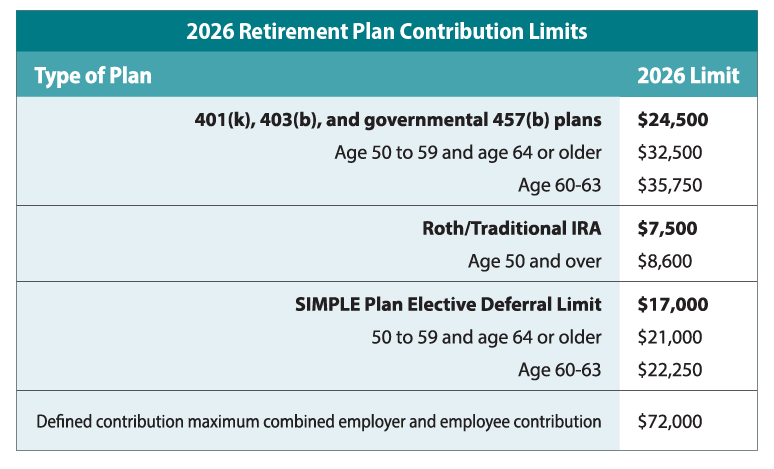

| Topic | 2026 Limit | Notes |

|---|---|---|

| 401(k) Contribution Limit | $24,500 | Up $1,000 from 2025 |

| 401(k) Catch-Up Contribution | $8,000 | For ages 50+; up $500 from 2025 |

| IRA Contribution Limit | $7,500 | Up $500 from 2025 |

| IRA Catch-Up Contribution | $1,100 | For ages 50+; up $100 from 2025 |

| Income Phase-Out for Roth IRA | $153,000-$168,000 (singles) | Adjusted for inflation |

| Income Phase-Out for IRA Deductibility | $81,000-$91,000 (singles) | Higher thresholds; varies by filing status |

| SIMPLE IRA Contribution Limit | $17,000 | Up $500 from 2025 |

| Official Source | IRS Retirement Plan Limits 2026 |

What Are These 401(k) and IRA Limits, and Why Do They Matter?

A 401(k) is a retirement plan offered by many employers that allows you to put aside money before taxes are taken out, often with a convenient employer match. An IRA (Individual Retirement Account) is an account you set up independently to grow your retirement savings tax-efficiently.

The government sets annual contribution limits to keep things fair and financially balanced. These limits adjust with inflation to help your retirement savings keep pace with rising living costs. In 2026, the IRS raised the limits on both 401(k)s and IRAs, stepping up your savings game.

The Bottom Line: 2026 Contribution Limits in Detail

A Bigger 401(k) Bucket

- Contribution limit: $24,500 (up $1,000 from 2025’s $23,500).

- Catch-up contribution for 50+: $8,000 (up from $7,500).

Together, if you’re 50 or older and max out your contributions, you could stash away up to $32,500!

IRA Limits Grow Too

- Standard IRA limit: $7,500 (up $500 from 2025).

- Catch-up for 50+: $1,100 (up from $1,000).

SIMPLE IRA Plans

- Contribution limits increase to $17,000, with a $4,000 catch-up.

Income Limit Considerations

Your income can affect how much of your IRA contributions are deductible and whether you qualify for Roth IRA contributions:

- Single filers have a deductible IRA phase-out at $81k to $91k.

- Married couples filing jointly phase out at $129k to $149k.

- Roth IRA phase-outs for singles are $153k to $168k.

This means if you earn above these brackets, your contributions might be limited, so plan accordingly.

Legislative Boosts: The SECURE 2.0 Act and Its Impact

Passed recently, the SECURE 2.0 Act adds fresh incentives and new rules to turbocharge your retirement savings:

- Required Minimum Distribution (RMD) age increased to 73, then 75, allowing your money to grow longer without forced withdrawals.

- Higher catch-up contributions for those over 60 starting in 2025.

- Automatic enrollment in 401(k)s encouraged to boost participation.

These changes are tailored to give savers more freedom and flexibility—like giving your savings a longer runway to grow and helping nudge you into action if you haven’t started yet.

The Reality Check: Can the Average American Keep Up?

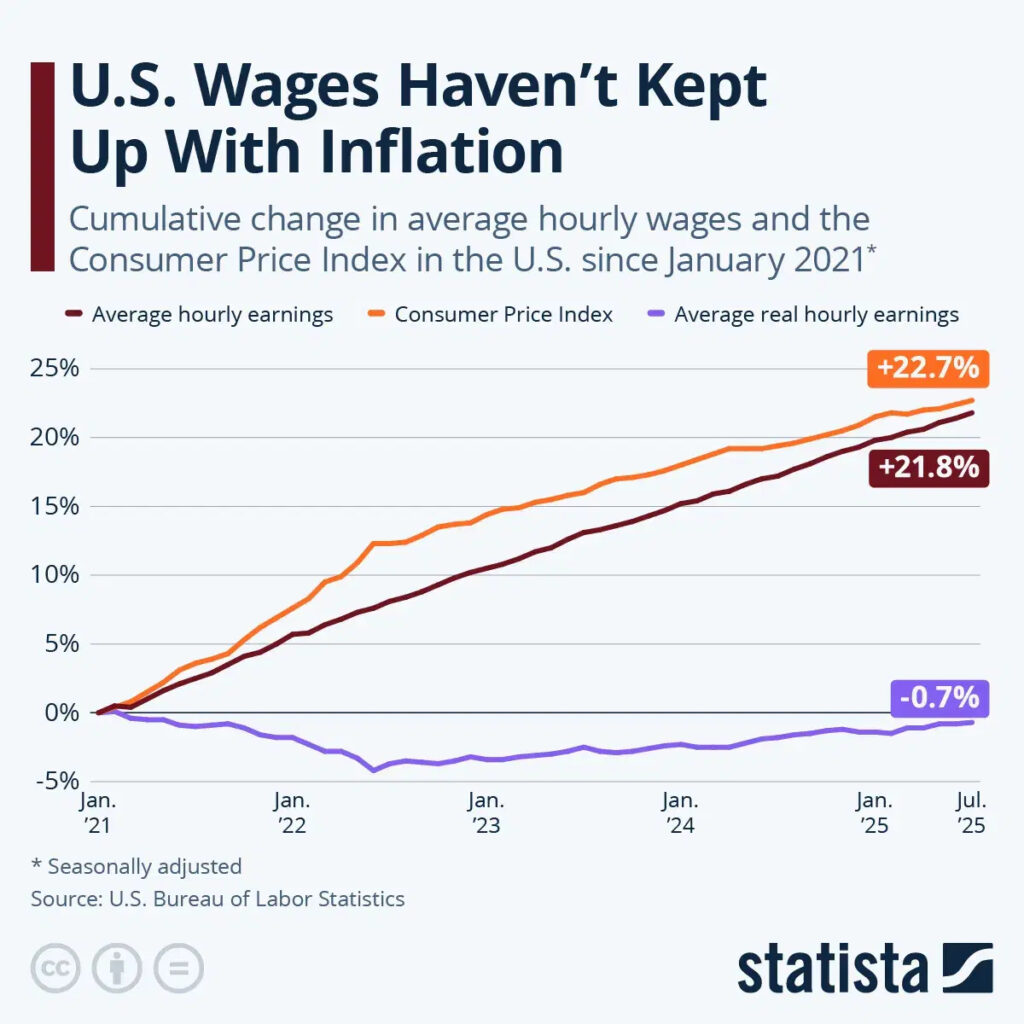

Look, maxing out your 401(k) and IRA is the dream, but the grind is tough for many. Data shows:

- Around 50% of Americans have less than $10,000 saved for retirement.

- Inflation and housing crunch hit paychecks hard.

- Student debt and family costs often take priority over savings.

That said, don’t get discouraged. Saving something consistently—even if it’s less than these max limits—adds up over time. It’s about progress, not perfection.

Practical Steps to Boost Your Retirement Game

Here’s how to level up your retirement savings, even if you’re feeling the squeeze:

- Max Out Employer Match — No Excuses

Your 401(k) match is literally free money. Make sure you grab it—never walk away from that. - Start Small and Build Gradually

Set automatic monthly contributions—even 1% of your paycheck helps—and increase it yearly or as you get raises. - Use “Catch-Up” if You’re Late to the Party

If you’re over 50, take advantage of those extra thousands to close the gap fast. - Mix It Up With Roth and Traditional Accounts

Tax planning minimizes what Uncle Sam takes at retirement. Roth IRAs and 401(k)s let you pay taxes upfront; traditional accounts defer taxes now. - Track Spending and Cut Non-Essentials

Getting serious about savings might mean tightening some purse strings on eating out or subscription services. - Don’t Forget Other Tax-Advantaged Accounts

Health Savings Accounts (HSAs) can also play a big role in retirement planning for medical costs. - Seek Professional Advice

A financial advisor can help tailor a plan that fits your unique situation and goals.

401(k) and IRA Limits Are Rising: Planning for Different Life Stages

Your retirement strategy should shift depending on where you are in your financial journey:

- Early Career (20s-30s): Focus on building emergency savings and starting 401(k) contributions for compound growth.

- Mid-Career (40s-50s): Aim to ramp up contributions, catch up on any shortfalls, and diversify investments.

- Near Retirement (60+): Maximize catch-up contributions, evaluate withdrawal strategies, and plan for healthcare costs.

Every stage needs a tailored approach to stay on track.

The Psychology of Saving: Staying Motivated

Saving for retirement is a marathon, not a sprint. Many people delay saving due to present-day challenges or feeling overwhelmed. Here’s how to stay motivated:

- Set Short-Term Milestones: Celebrate when you hit savings goals. Small wins build big momentum.

- Visualize Your Retirement Life: Picture what you want retirement to look like to stay inspired.

- Automate to Eliminate Temptation: Automate contributions so you don’t have to wrestle with decisions monthly.

- Engage Family in Financial Talks: Shared goals can help keep everyone on the same page.

The Tax Impact: Understanding How Contributions Affect Your Taxes

Your choice between traditional and Roth accounts affects your tax bill today and tomorrow. With traditional 401(k)s and IRAs, contributions are made pre-tax, lowering your taxable income now, but you’ll pay taxes when you withdraw during retirement. Roth accounts, by contrast, use post-tax dollars. Your contributions don’t reduce your current taxable income, but qualified withdrawals in retirement are tax-free.

Higher contribution limits in 2026 mean more potential tax sheltering — but it’s important to weigh your current tax bracket against expected future rates to decide which account makes the most sense.

How Inflation and Cost of Living Affect Retirement Savings?

While the IRS has increased contribution limits to keep pace with inflation, the cost of living in many parts of the U.S. has skyrocketed beyond the average wage increase. Housing prices, utilities, groceries, healthcare, and childcare take growing chunks of monthly income. This puts retirement saving in competition with immediate financial needs, forcing tough choices for many families.

Understanding and planning for this reality is essential. Budgeting realistically, avoiding lifestyle inflation, and seeking ways to increase earnings or reduce debt can provide the breathing room needed to ramp up retirement contributions.