Social Security Just Got a Raise: If you’re drawing Social Security benefits, or planning to soon, you’re gonna want to hear this. Social Security payments are getting a boost in 2026 thanks to a 2.8% cost-of-living adjustment (COLA). That means more dough in your pocket every month, whether you’re retired, disabled, or a spouse relying on these benefits. So, what’s the full scoop? How much more will you get? And what else should you watch out for? Let’s break it down from A to Z — in plain, friendly talk — so you can plan ahead and make the most of your Social Security in 2026.

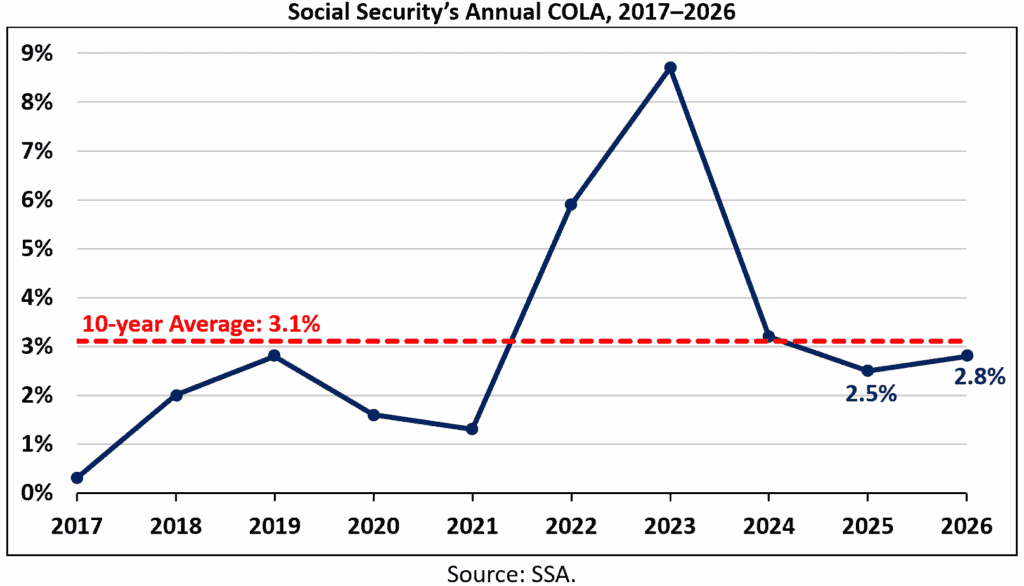

Social Security keeps millions of Americans afloat, especially seniors and those with disabilities. It adjusts annually to keep up with inflation, which means your check usually grows when prices rise. For 2026, the Social Security Administration (SSA) has announced a 2.8% increase — a bit higher than last year’s 2.5%, but healthcare costs and other expenses are still on the climb. Below, you’ll find a clear rundown of what this means exactly for you or your family — complete with numbers, practical advice, and links to official info. Whether you’re a retiree, a spouse, someone on disability, or just curious about how the system works, this article’s got something for everyone.

Table of Contents

Social Security Just Got a Raise

The 2026 Social Security increase is welcome news for millions of Americans, giving a 2.8% cost-of-living adjustment that means more money in your pocket every month. While rising Medicare costs might bite into this gain, understanding the details and planning smartly will help you get the most out of your benefits. Whether you’re retired, disabled, or a spouse relying on Social Security, keep an eye on your annual statement, budget carefully, and stay informed to make confident decisions about your financial future.

| Topic | 2025 Amount | 2026 Amount | Notes |

|---|---|---|---|

| Average Retiree Benefit | $2,015 per month | $2,071 per month | $56/month more on average |

| Spousal Benefit | $954 per month | $981 per month | $27/month increase |

| Survivor Benefit | $1,575 per month | $1,619 per month | $44/month increase |

| Disabled Worker Benefit | $1,586 per month | $1,630 per month | $44/month increase |

| Supplemental Security Income (SSI) | $967 individual | $994 individual | For individuals, monthly amount |

| Maximum Social Security Benefit | $4,018 per month | $4,152 per month | Max benefit for full retirement age |

| Earnings Limit (Below Full Retirement Age) | $23,400/year | $24,480/year | Earnings above reduce your benefits temporarily |

| Medicare Part B Premium | $185/month | $202.90/month | Significant 9.7% increase, may offset COLA |

What Is the Social Security Cost-of-Living Adjustment (COLA)?

COLA is an automatic yearly increase to Social Security and Supplemental Security Income (SSI) payments. It’s designed to help benefits keep pace with inflation — basically, making sure your benefits don’t lose buying power as prices go up for stuff like groceries, utilities, and healthcare.

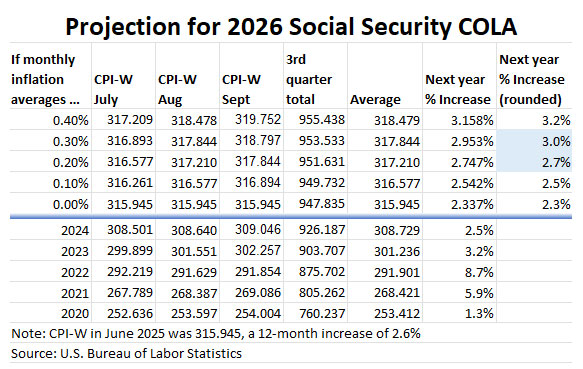

For 2026, based on the Consumer Price Index (CPI-W), the SSA announced a 2.8% increase in benefits starting January 2026 for about 71 million people receiving Social Security, and an increase for nearly 7.5 million SSI recipients starting December 31, 2025.

Keep in mind, the COLA isn’t set by politicians or lawmakers but is calculated automatically based on inflation measured during the third quarter of the previous year to the same quarter in the current year. This makes it a fair and transparent way to adjust benefits.

How Much More Will You Get in 2026?

Here’s the breakdown by category, so you can see the specific increases:

Retirees

The average monthly retirement benefit will go from about $2,015 to $2,071, which adds an extra $56 per month. If you’re relying on Social Security retirement income, that means a little extra breathing room for your budget — maybe some extra fun money or to cover rising essentials.

Spouses and Survivors

If you receive benefits as a spouse or survivor, your checks will rise too. Spousal benefits increase from $954 to $981 per month, and survivor benefits go up from $1,575 to $1,619 per month.

Disabled Workers

For those on disability benefits, the average monthly amount increases from $1,586 to $1,630, giving an added $44 to help cover living expenses.

Supplemental Security Income (SSI)

SSI, which assists low-income seniors and disabled individuals, gets a bump too. The standard payment for an individual rises from $967 to $994 monthly, and for couples from $1,450 to $1,491.

Maximum Benefit

If you’re eyeing the highest possible Social Security benefit (which is for those retiring at full retirement age with max earnings), that jumps from about $4,018 to $4,152 per month in 2026.

Social Security Just Got a Raise: Medicare and Earnings Limits

While the COLA is great news, there’s a catch for many: Medicare Part B premiums are increasing sharply.

- In 2026, Medicare Part B premiums rise 9.7% to $202.90 per month (up from $185 in 2025). This increase may eat into your COLA bump, meaning the actual extra money you see might be less than $56 after the premium is taken out.

- If you have other Medicare costs, those could rise too.

The increase in Medicare premiums often hits retirees before they get the full benefit of their COLA. Many people will find that after Medicare premiums are deducted, the net increase in their benefits is closer to $39 per month rather than the full $56.

- For those still working and receiving Social Security benefits before full retirement age, the earnings limit increases to $24,480 annually (up from $23,400). If you make more than this, your Social Security benefits might be temporarily reduced — but those withheld benefits get credited back once you hit full retirement age.

- The limit for those reaching full retirement age in 2026 rises to $65,160.

Social Security Changes You Should Prepare For in 2026

It’s not just about the increase; some changes require a heads-up. Here’s how to stay ahead.

1. Check Your Social Security Statement Early

SSA sends out annual benefit statements in the fall that detail your new benefit amount for the coming year. This statement is key to understanding your payments and any deductions, like Medicare premiums. If you don’t receive one, you can view your statement online at ssa.gov.

2. Adjust Your Budget for Medicare Premiums

Budgeting matters more than ever. Many seniors may see a reduced increase after the new Part B premium is deducted. Planning for this can avoid financial surprises. If this is a hardship, some may qualify for assistance programs depending on income.

3. Know the Earnings Limits if You’re Working

If you’re under full retirement age and working, know your earnings cap to avoid benefit reductions. If you’re near retirement, it can be smart to time your earnings and benefits for maximum advantage.

4. Consider Tax Implications of Your Benefits

Depending on your combined income, Social Security can be taxable. For some, this means paying taxes on up to 85% of their benefits. Tax planning or speaking with a financial advisor can help reduce surprises at tax time.

5. Maximize Retirement by Timing Your Claim

If you haven’t started your benefits yet, consider that benefits increase for each year you delay past your full retirement age up to age 70. This strategy could boost your monthly check by as much as 8% per year.

6. Stay Informed on Other Changes

The Social Security system periodically updates rules about benefits, eligibility, and taxes. Following SSA news sources and trusted financial advice sites will help you stay up to date.

How Social Security Just Got a Raise Fits into Your Broader Retirement Plan?

Social Security is usually a key income source for retirees, but it’s not the whole story. Think of it as part of a broader picture including savings, pensions, and investments.

- Diversify your income sources: Don’t put all your eggs in one basket. Use Social Security alongside IRAs, 401(k)s, and other investments.

- Plan for healthcare costs: Rising Medicare expenses and out-of-pocket health costs can eat into your budget.

- Emergency funds: Unexpected expenses still happen. Keeping a reserve fund is critical.

- Seek professional advice: Retirement planning can be complex, and personalized advice often pays off.