AARP Issues Urgent Warning on Social Security: Social Security is a cornerstone of retirement and financial security for millions of Americans. But right now, AARP is waving a big red flag that everyone needs to hear about. In this article, we’ll break down the urgent warning from AARP, explain what it means for you and your family, and offer practical advice on how to maximize your Social Security benefits. Whether you’re 25 or 65, this info matters.

Social Security’s future looks iffy. According to AARP, the program’s Old-Age and Survivors Insurance (OASI) trust fund is projected to be able to pay full benefits only until 2033. After that, unless Congress steps in, benefits will be cut to about 77% of what they are scheduled to pay now. In other words, without action, retirees could see their Social Security checks shrink by nearly a quarter starting in just eight years. That’s a big deal when many depend on these payments to cover essentials like rent, groceries, and healthcare.

Table of Contents

AARP Issues Urgent Warning on Social Security

The AARP’s urgent warning on Social Security highlights a critical challenge facing millions of Americans: the program’s funding is set to hit a cliff in 2033, risking steep benefit cuts. That means everyone—whether you’re planning retirement, supporting loved ones, or advising clients—needs to pay attention now. By understanding how Social Security works, making smart claiming choices, and advocating for legislative solutions, you can protect your financial future. Remember: delaying your Social Security claim until 70 can significantly boost your monthly income, helping you weather any turbulent times ahead.

| Topic | Details |

|---|---|

| Social Security Trust Fund | Full benefits paid until 2033; cuts to 77% of benefits after that without congressional action |

| Best Claiming Age | Delay benefits until age 70 to maximize monthly payments (+8% per year after full retirement age) |

| Cost-of-Living Adjustment (COLA) | 2.5% increase in 2025; 2.8% projected for 2026 |

| Tax Benefits for Over 65 | Temporary $6,000 tax deduction for taxpayers 65+, phasing out at higher incomes until 2028 |

| Congressional Action Needed | Urgent bipartisan legislation to prevent drastic benefit cuts |

| Official Resource | Social Security Administration (SSA) |

What is Social Security and Why Does It Matter?

Social Security is a government program designed to provide income to retirees, disabled individuals, and survivors of deceased workers. For many, it’s the main source of retirement income. According to AARP, over 60 million Americans receive Social Security benefits, making it a lifeline for a vast part of the population.

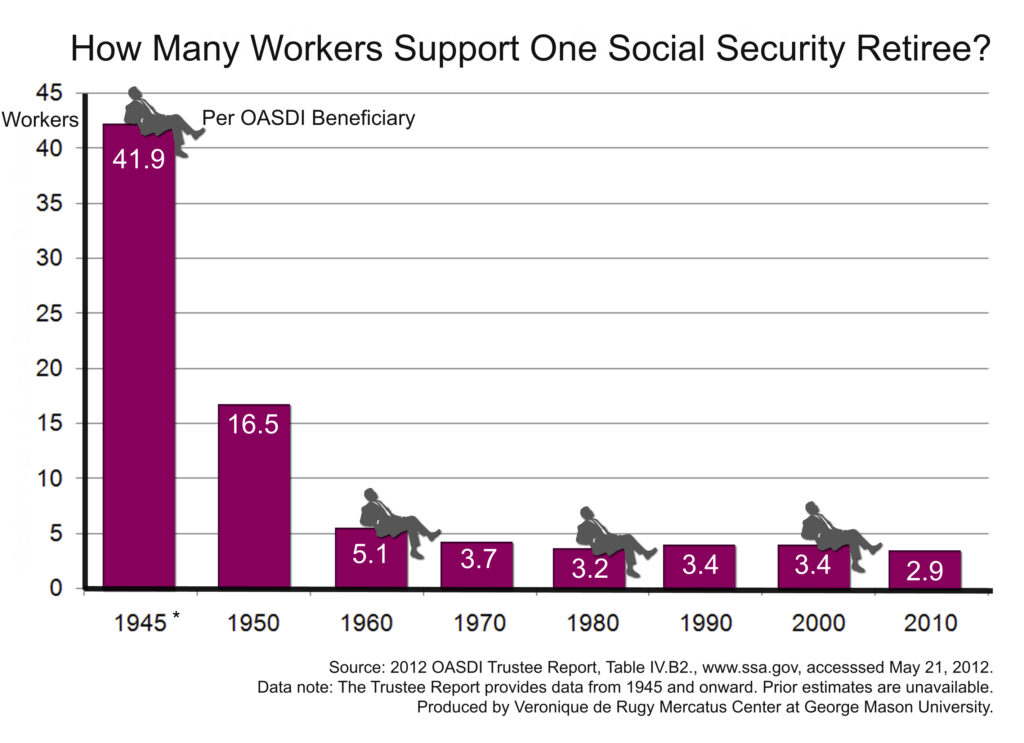

Think of Social Security as a safety net. You and your employer pay into it through payroll taxes, and when you retire—or if you become disabled or a spouse loses their partner—you get paid back from this collective fund. But here’s the catch: the money in this trust fund isn’t bottomless. It relies heavily on working Americans paying in today to support those receiving benefits now.

What’s the AARP Issues Urgent Warning on Social Security All About?

AARP’s warning centers on the fact that the Social Security trust fund is projected to run out of its reserves by 2033. After this, incoming funds from payroll taxes can only support about 77% of promised benefits. This shortfall means if Congress doesn’t act, older Americans could face benefit cuts potentially shrinking their monthly checks by nearly a quarter.

How did we get here?

- Demographic Shifts: Baby boomers retiring, fewer workers per retiree.

- Longer Life Expectancy: People living longer, drawing benefits for extended periods.

- Payroll Tax Limits: Income above a taxable maximum isn’t taxed for Social Security, limiting revenue.

AARP is emphasizing this warning now because time is ticking for lawmakers to fix the program before these cuts affect millions of retirees.

The Math Behind the AARP Issues Urgent Warning on Social Security: Understanding the Trust Fund

The Social Security Old-Age and Survivors Insurance trust fund currently holds roughly $2.9 trillion in assets. These reserves serve as a backup to pay benefits during times when incoming taxes fall short. However, projections show that by 2033, the trust fund will be depleted due to a combination of increased benefit payments and slower growth in payroll tax revenue.

Once the reserve runs out, Social Security will only be able to pay what comes in from current payroll taxes, which covers about 77% of the benefits owed. The remaining 23% would represent lost income for retirees unless Congress authorizes new funding measures.

This depletion stems from a demographic trend: the ratio of workers paying into the system compared to beneficiaries is shrinking. Back in 1960, there were roughly 5 workers per retiree; today, there are about 2.6, projected to drop further.

Practical Advice: How Social Security Claiming Works

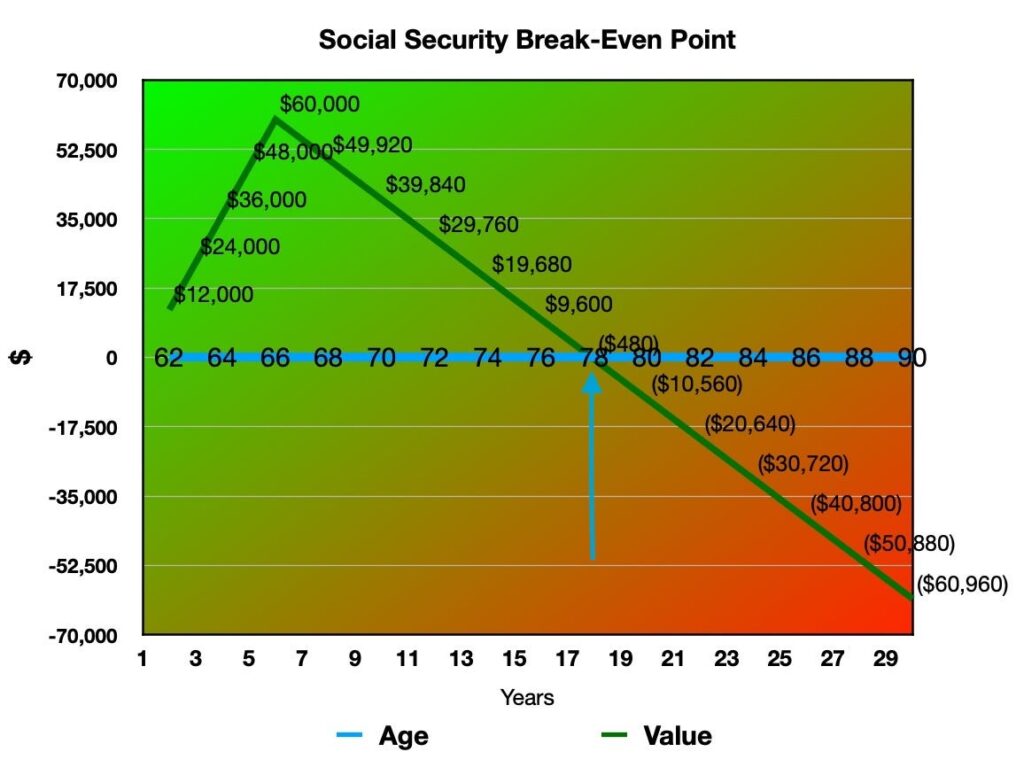

Many Americans don’t fully understand how their claiming age affects the size of their Social Security checks. Here’s a simple breakdown:

- Early claim (age 62): You can start collecting Social Security benefits, but you’ll receive about 25% to 30% less than your full retirement benefit for life.

- Full retirement age (FRA): Usually between 66 and 67, depending on your birth year. At this age, you get your full benefit.

- Delayed claim (up to age 70): Your benefit increases by 8% annually beyond your FRA until age 70, boosting your monthly income.

For example: If your full retirement benefit at age 66 is $1,000/month, claiming at age 62 lowers it to roughly $700/month. However, waiting until 70 boosts it to about $1,320/month.

Why delay benefits?

- Longevity protection: If you expect to live into your 80s or longer, delaying benefits safeguards against outliving your money.

- Higher survivor benefits: Delaying can increase benefits for your spouse or survivors.

- Budget management: You can plan your finances knowing your higher future monthly income.

Challenges in the Current Social Security System

Beyond funding, the Social Security Administration (SSA) faces issues with customer service and administrative efficiency. AARP reports growing frustration among beneficiaries who experience long wait times for help, delays in processing claims, and difficulty navigating complex rules.

Moreover, the program faces criticism for its outdated tax structure—income over a certain level ($168,600 in 2025) isn’t taxed for Social Security. Some proposals include increasing or removing this cap to generate more revenue.

How Congress Can Fix Social Security?

Several measures are being discussed in Washington to shore up Social Security:

- Increase payroll taxes: Even a small increase can extend fund solvency by decades.

- Raise the taxable income cap: Tax earnings above $168,600 to increase revenue.

- Adjust benefit formulas: Potentially slowing the growth of benefits for higher earners.

- Raise the retirement age: Reflecting longer life expectancies.

- Adopt progressive benefits: Offering greater support to low-income retirees.

AARP advocates for bipartisan efforts to take action before the fund runs dry to avoid automatic cuts.

Cost-of-Living Adjustments and Inflation Protection

Social Security benefits generally increase annually to keep up with inflation. The 2025 Cost-of-Living Adjustment (COLA) was 2.5%, based on inflation measures, and projections for 2026 indicate a 2.8% increase. However, inflation remains volatile, and exact increases may vary.

These COLA increases are crucial because they preserve the purchasing power of Social Security checks, especially for seniors on fixed incomes.

How Social Security Interacts with Other Income Sources?

Many retirees combine Social Security with pensions, savings, and investments. Managing claiming strategies alongside other income sources can optimize tax outcomes and financial security.

For instance, if your combined income is high, up to 85% of Social Security benefits can be taxable. Proper planning can minimize taxes on your retirement income.